Kitchener Conservative asks: Is it Time For Garth To Leave Blogging Tories? The short answer is no.

Garth is a publicity hound. If he doesn't make it in politics, he will seek some other venue to stroke his enormous ego. Kicking him out of the Blogging Tories would only give him more attention.

Turner's tactics are questionable at best, and given time will likely backfire. His actions suggest that he is plotting a media career after he fails in politics. We all have our reasons for blogging, but if Garth self identifies as a Blogging Tory, so be it. The Blogging Tories serves as a blog aggregator, not an arbiter of opinion. I actually agree with him on some things. It his just his tactics I abhor.

However, if Turner is so concerned about all those Canadians who seem to have lost their life savings because of a decision to tax non-taxable investors, then his attention would best be directed at the financial advisors and DIY investors who put all their money into income trusts.

If you can't stand the heat of the stock market, then invest in GICs. Stock markets are inherently risky and that is why it is best to diversify your investments across asset classes. If Canadians ignore this fundamental tenet of portfolio management, they have no one to blame but themselves. Sure, Flaherty's decision hurt, but a diversified portfolio would have largely protected you.

Fundamentally, Garth is arguing against individual responsibility. He seems to want the government to guarantee people's investments. That would be an absolute disaster for the Canadian economy as capital would be allocated without any consideration of risk. Ultimately, the decision to tax income trusts has provided a warning to all investors that there is no sure thing. If you haven't heard it before, the best advice is don't put all your eggs in one basket.

Sunday, November 05, 2006

Saturday, November 04, 2006

Thanks Amazon.ca

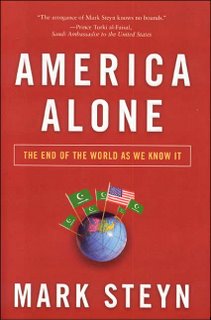

I got my copy of Mark Steyn's new book America Alone

I got my copy of Mark Steyn's new book America AloneApparently, Paul Well's book Right Side Up

Thanks Amazon.ca.

Saved by technology?

Claims that technology may provide the solution to climate change is subject to considerable ridicule. Yet without technology, the prospects of significantly reducing greenhouse gases and not killing the economy at the same time are remote. Fortunately, scientists and entrepreneurs are ignoring the naysayers and working to develop new and existing technologies to reduce the carbon imprint of our lifestyles.

For example, LEDs hold considerable promise in reducing future energy consumption:

In a similar vein, Amory Lovins has argued that by lightweighting our automobiles and switching to biofuels to run them, we could cut our oil consumption for automobile transportation to zero by 2040.

Closer to home, residential and commercial developers are working with firms such as Clean Energy Developments to tap growing consumer demand for clean energy systems. Technologies such as geothermal exchange can reduce a property's heating and cooling costs to a small fraction of traditional methods.

Taken singly, the impact of any of these methods alone is minimal. But cumulatively, it adds up.

Many promising technologies such as carbon sequestration in oil and gas, afforestation, and biomass-based energy are also being pursued. Our cause is certainly not hopeless, whether it is to reduce carbon or to wean ourselves from Middle-East oil. Ten years from now, we may even consider Kyoto to have been excessively unambitious. It won't happen overnight, but given sufficient time, the problems are not insurmountable. Scepticism about human ingenuity is understandable, but we may yet be saved by technology.

For example, LEDs hold considerable promise in reducing future energy consumption:

Light-emitting diodes will become economically attractive as replacements for conventional lightbulbs in about two years, a shift that could pave the way for massive electricity conservation, according to a researcher.

Right now, consumers and businesses can buy a light-emitting diode, or LED, that provides about the same level of illumination as an energy-hogging conventional 60-watt lightbulb, Steven DenBaars, a professor of material science at the University of California Santa Barbara, said at the SEMI NanoForum, taking place here this week. A principal advantage of the LED: It lasts about 100,000 hours, far longer than the conventional filament bulb.

Unfortunately, the LEDs that can perform this task cost about $60, he said. (Prices vary on the Internet.) But prices have been declining by 50 percent a year, so two years from now the same LED should cost around $20.

"At $20 the payback in energy occurs in about a year," DenBaars said. The rapid return on investment will occur in places such as stores and warehouses, where the light is on through much of the day. A year after that, LEDs will be even more economical for more places as costs continue to decline.Approximately 22 percent of the electricity consumed in the United States goes toward lighting, according to the U.S. Department of Energy

To make matters worse, traditional lightbulbs are incredibly inefficient. Only about 5 percent of the energy that goes into them turns into light. The majority gets dissipated as heat.

If 25 percent of the lightbulbs in the U.S. were converted to LEDs putting out 150 lumens per watt (higher than the commercial standard now), the U.S. as a whole could save $115 billion in utility costs, cumulatively, by 2025, said DenBaars, and it would alleviate the need to build 133 new coal-burning power stations.

In a similar vein, Amory Lovins has argued that by lightweighting our automobiles and switching to biofuels to run them, we could cut our oil consumption for automobile transportation to zero by 2040.

Closer to home, residential and commercial developers are working with firms such as Clean Energy Developments to tap growing consumer demand for clean energy systems. Technologies such as geothermal exchange can reduce a property's heating and cooling costs to a small fraction of traditional methods.

Taken singly, the impact of any of these methods alone is minimal. But cumulatively, it adds up.

Many promising technologies such as carbon sequestration in oil and gas, afforestation, and biomass-based energy are also being pursued. Our cause is certainly not hopeless, whether it is to reduce carbon or to wean ourselves from Middle-East oil. Ten years from now, we may even consider Kyoto to have been excessively unambitious. It won't happen overnight, but given sufficient time, the problems are not insurmountable. Scepticism about human ingenuity is understandable, but we may yet be saved by technology.

Thursday, November 02, 2006

Too many eggs in the income trust basket

Investors are understandably upset with the Conservative government's proposed tax on income trust distributions. Share prices for income trusts declined about 12% yesterday. A change in government policy, however, is one of the many risks of investing in the stock market.

That is why financial advisers routinely recommend a well-diversified portfolio with holdings across asset classes. Holding all your eggs in the income-trust basket is simply asking for trouble. Consequently, it is hard to feel sorry for people like this guy:

With any policy change, it is inevitable that some people will benefit and some people will get hurt. But this guy has clearly ignored the basic tenets of portfolio diversification: don’t put all your eggs in one basket. Rather than blaming the government, people should be taking it up with their financial advisor since it was common knowledge that something would have to give, particularly once BCE announced its intention to convert to the income trust structure.

In my view, Flaherty's decision on income trusts was a bold and brilliant move. Basically, it levels the playing field between corporations and income trusts, without raising the overall tax burden. At the same time, Canadian taxpayers will no longer be subsidizing foreign investors in Canadian income trusts.

Unlike Ralph Goodale, the previous Liberal Finance Minister, Flaherty acted quickly and decisively on this issue. Canada now has a tax policy that will require CEOs to focus on creating shareholder value the traditional way—by succeeding in the marketplace—rather than through financial and tax legerdemain. For seniors and other income trust investors, the damage is smartly mitigated by a phase-in period for existing trusts and income-splitting measures for pensioners.

Still, those investors affected by the change need to realize that their cash flows from income trust investments will not change very much if they were already being taxed at the personal level. While the decline in income trust share prices will hurt when it comes time to draw upon one's capital in late-retirement years, effective yields have now gone up (since the shares are less attractive to non-taxable and foreign investors and prices have gone down), which is good for those making new investments in existing income trusts.

The fallout from this decision illustrates one of the pitfalls of DIY investing. Too many investors, regrettably many of them seniors, do not seem to be cognisant of the investment risks of their portfolios. Yet they manage portfolios worth hundreds of thousands of dollars or more by themselves. While the yields on income trusts may seem attractive, there is a reason for it – they are risky investments, not GICs. Putting all your money in the income trust basket is not a very prudent approach to take in managing one's retirement savings. Any responsible financial advisor will tell you that. The government may make a convenient scapegoat for your incompetence, but ultimately, if you got hurt, you have only yourself to blame.

That is why financial advisers routinely recommend a well-diversified portfolio with holdings across asset classes. Holding all your eggs in the income-trust basket is simply asking for trouble. Consequently, it is hard to feel sorry for people like this guy:

Richard Milne, 74, who has invested most of his family’s savings in income trusts, estimated his losses following Tuesday’s tax decision at $50,000, although he says he hopes for some rebound. "They reneged on their promise," he said. "That really upsets me."

With any policy change, it is inevitable that some people will benefit and some people will get hurt. But this guy has clearly ignored the basic tenets of portfolio diversification: don’t put all your eggs in one basket. Rather than blaming the government, people should be taking it up with their financial advisor since it was common knowledge that something would have to give, particularly once BCE announced its intention to convert to the income trust structure.

In my view, Flaherty's decision on income trusts was a bold and brilliant move. Basically, it levels the playing field between corporations and income trusts, without raising the overall tax burden. At the same time, Canadian taxpayers will no longer be subsidizing foreign investors in Canadian income trusts.

Unlike Ralph Goodale, the previous Liberal Finance Minister, Flaherty acted quickly and decisively on this issue. Canada now has a tax policy that will require CEOs to focus on creating shareholder value the traditional way—by succeeding in the marketplace—rather than through financial and tax legerdemain. For seniors and other income trust investors, the damage is smartly mitigated by a phase-in period for existing trusts and income-splitting measures for pensioners.

Still, those investors affected by the change need to realize that their cash flows from income trust investments will not change very much if they were already being taxed at the personal level. While the decline in income trust share prices will hurt when it comes time to draw upon one's capital in late-retirement years, effective yields have now gone up (since the shares are less attractive to non-taxable and foreign investors and prices have gone down), which is good for those making new investments in existing income trusts.

The fallout from this decision illustrates one of the pitfalls of DIY investing. Too many investors, regrettably many of them seniors, do not seem to be cognisant of the investment risks of their portfolios. Yet they manage portfolios worth hundreds of thousands of dollars or more by themselves. While the yields on income trusts may seem attractive, there is a reason for it – they are risky investments, not GICs. Putting all your money in the income trust basket is not a very prudent approach to take in managing one's retirement savings. Any responsible financial advisor will tell you that. The government may make a convenient scapegoat for your incompetence, but ultimately, if you got hurt, you have only yourself to blame.

Subscribe to:

Comments (Atom)